Modern companies grow with Remote

Payroll trusted by global teams

Your in-house payroll partner

Supercharge your payroll capabilities with the power of Remote. Whether you have a robust payroll department or zero in-house expertise, we help you do more.

Compliance made easy

Staying compliant with payroll laws is tricky, especially across international borders. Remote Payroll keeps you compliant everywhere so you can pay your team with confidence.

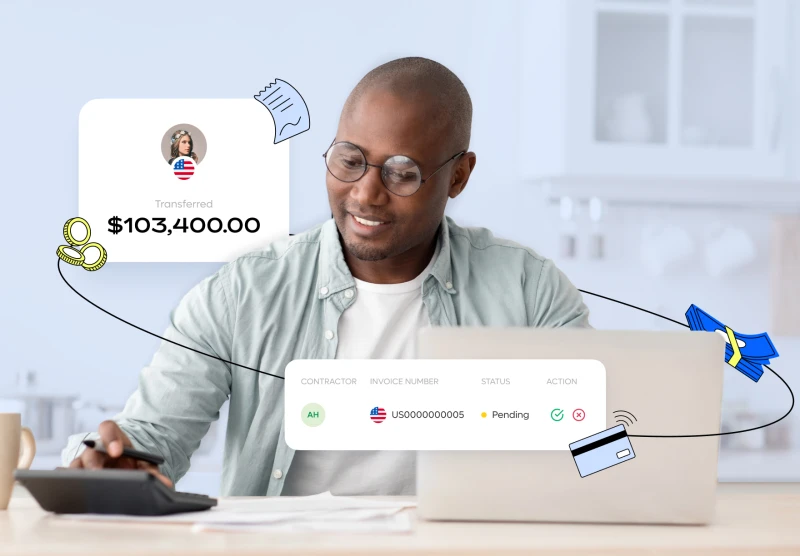

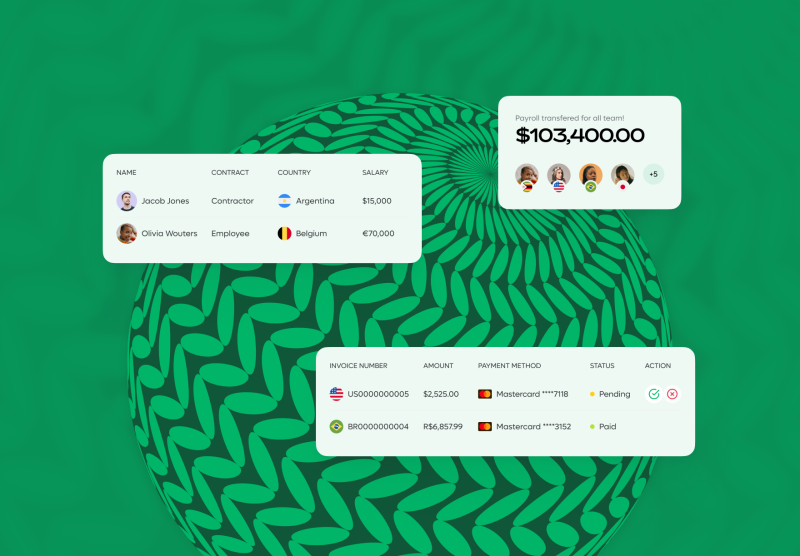

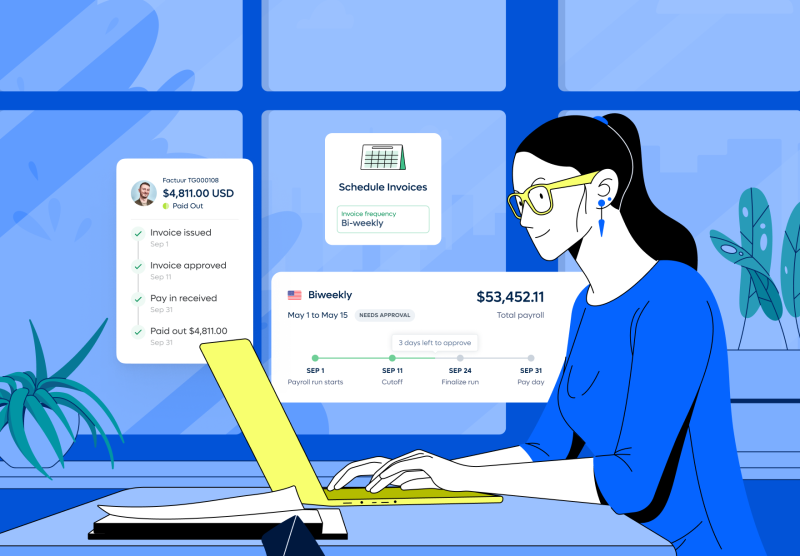

One centralised payroll platform

Using multiple third parties to handle payroll at home and abroad? Consolidate with Remote Payroll to handle everything in one browser tab.

See just how easy global payroll can be

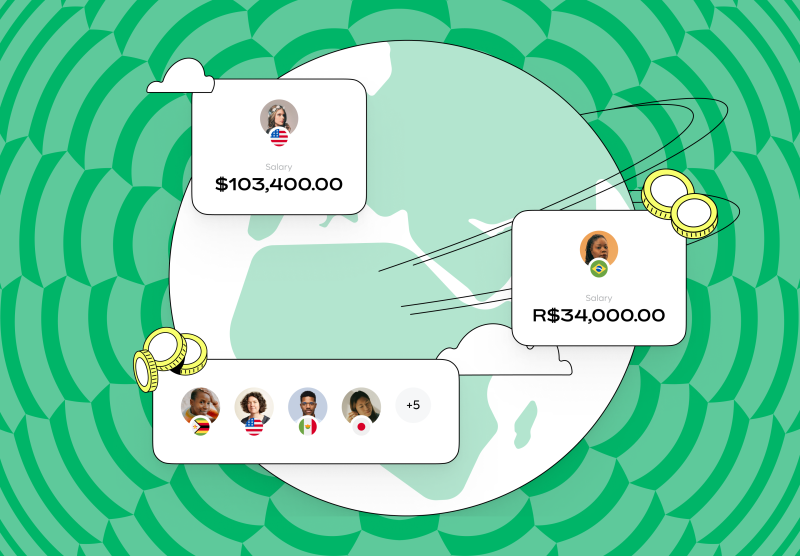

Remote Payroll covers your whole team, everywhere.

Your in-house payroll partner

We simplify global payroll, bringing global expertise so you don’t need local offices. Our adaptable platform supports your growth, letting you focus on your business while we take care of payroll, saving you time and reducing hassle.

Compliance made easy

Effortlessly navigate global regulations with our automated updates, keeping your business compliant. Enjoy peace of mind with enhanced IP protection and integrated payroll payments, streamlining your international operations.

One centralised payroll platform

Manage your entire workforce with ease and efficiency using our centralised payroll platform. From running payroll to automating expense management and generating reports, our platform simplifies every aspect of payroll administration, all in one place.

Always fair pricing

We don’t like hidden fees and third-party add-ons. So we don’t charge any. Our flat-rate pricing plans let you predict your bill with pinpoint accuracy every time.

Payroll

Consolidate your multi-country payroll

$43

per employee/month

Top features

Simplify: Comprehensive platform that integrates all payroll functions

Support: Personalised assistance with a dedicated team and specialists

Accuracy: Test runs and parallel pay runs before implementation

Compliance: Adhere to local labour laws in every country

Timeliness: Accurate and on-time payroll with labour authority reporting handled

Experience: Seamless payroll with easy access to payslips and expenses

Expert Payroll insights, just one click away

BlogGlobal Payroll

BlogGlobal PayrollRemote Global Benefits: Give distributed teams the best perks now

BlogGlobal Payroll

BlogGlobal PayrollSmall business accounting: A guide to the fundamentals

BlogGlobal Payroll

BlogGlobal PayrollIf you’re treating payroll as a back office function, you’re already behind the times

BlogGlobal Payroll

BlogGlobal PayrollAccrued payroll: What is it, and how do you track it?

BlogGlobal Payroll

BlogGlobal PayrollCan’t raise employee salaries? Then get them right: Payroll errors lead to quiet quitting

BlogGlobal Payroll

BlogGlobal PayrollCommon legal troubles for global businesses (and how to prevent them)

BlogGlobal Payroll

BlogGlobal PayrollManaging global payroll: the expert guide

BlogGlobal Payroll

BlogGlobal PayrollPayroll outsourcing: pros, cons, and how to do it successfully

BlogGlobal Payroll

BlogGlobal PayrollGlobal payroll trends: what your business should know

BlogGlobal Payroll

BlogGlobal PayrollHow to manage global compensation

BlogGlobal Payroll

BlogGlobal PayrollPayroll ACH: How does it help, and how do you set it up?

BlogGlobal Payroll

BlogGlobal PayrollShould your small business outsource payroll?

BlogGlobal Payroll

BlogGlobal PayrollPayroll costs: how can global businesses reduce payroll expenses?

BlogGlobal Payroll

BlogGlobal PayrollPayroll fraud: How to minimize the risk to your business

BlogGlobal Payroll

BlogGlobal PayrollPayroll funding: What is it, and when should you use it?

BlogGlobal Payroll

BlogGlobal PayrollGiving bonus payments to employees: What businesses should consider

BlogGlobal Payroll

BlogGlobal PayrollSocial Security payments for US employees: what businesses need to know

BlogGlobal Payroll

BlogGlobal PayrollHow to manage pay advances for your employees

BlogGlobal Payroll

BlogGlobal PayrollHow to manage retro pay and backdating

BlogGlobal Payroll

BlogGlobal PayrollCorrecting payroll errors: best practices for employers

BlogGlobal Payroll

BlogGlobal PayrollHow to conduct payroll audits as a global company

BlogGlobal Payroll

BlogGlobal PayrollOutsourced accounting: What are the benefits for businesses, and how does it work?

BlogGlobal Payroll

BlogGlobal PayrollThe top 8 benefits of using cloud-based payroll software

BlogGlobal Payroll

BlogGlobal PayrollExempt vs. non-exempt employees: what’s the difference, and why does it matter?

BlogGlobal Payroll

BlogGlobal PayrollGlobal payroll automation: How to simplify payroll for your international team

BlogGlobal Payroll

BlogGlobal PayrollHow can payroll analytics benefit your global business?

BlogGlobal Payroll

BlogGlobal PayrollHow does the Employee Retention Credit work?

BlogGlobal Payroll

BlogGlobal PayrollWhat is SWIFT (the Society for Worldwide Interbank Financial Telecommunication)?

BlogGlobal Payroll

BlogGlobal PayrollGlobal payroll technology: how can a payroll solution transform your business?

BlogGlobal Payroll

BlogGlobal PayrollBenefits of global payroll: what growth companies need to know

BlogGlobal Payroll

BlogGlobal PayrollPayroll without borders: expanding Global Payroll

BlogGlobal Payroll

BlogGlobal PayrollHow to pay international employees

BlogGlobal Payroll

BlogGlobal Payroll[Webinar Recording] Permanent establishment risk: Debunking the myths

BlogGlobal Payroll

BlogGlobal Payroll[Webinar Recording] Managing contractors and avoiding misclassification

BlogGlobal Payroll

BlogGlobal PayrollQuestions to ask before you outsource payroll

Frequently Asked Questions

Depending on your needs, you could have your team’s payroll up and running in just a few weeks, rather than the months it usually takes with other global payroll providers. You’ll have a dedicated implementation specialist to guide you step-by-step and collaborate on creating a tailored plan.

Remote makes it easy to run payroll globally in top tech talent hotspots like the UK, US, Netherlands, Spain, Portugal, Mexico, Ireland, South Africa, Indonesia, India, and many more. Our in-house team of local experts ensures that you comply with local payroll regulations, offering more flexibility, speed, and support since we don’t rely on third-party providers. We’re continually adding new countries each month. Reach out to our sales team to discover how we can cater to your global payroll needs.

At Remote, we take the security of your business and employee data very seriously. We are SOC 2 compliant and ISO27001 certified, so you can trust that your information is protected at every turn.

We enforce two-factor authentication (2FA) and offer single sign-on (SSO) for extra security layers.

Additionally, our security policies and procedures are routinely audited by independent third-party experts. Learn more about our security measures at Remote.

Yes, in some countries, Remote can automatically pay your employees and tax authorities using standard bank payment methods.

After you’ve gone through our thorough and secure payments onboarding process, you can top up your virtual payroll wallet via bank transfer. Once you’ve approved the monthly payroll, we’ll securely transfer payments to your employees and tax authorities in local currencies. You’ll have full visibility into the status of each payment.

For all countries, you can also access a ‘bank file’ that can be uploaded into your banking software, making it easy to schedule salary, benefit, and tax payments if you choose not to use our integrated payment network.

Paying employees overseas usually means you need:

A local business entity

A local bank account

Registration with local tax and labour authorities

If this sounds like a hassle, our Employer of Record service can help. It allows you to hire employees overseas without setting up local entities. We handle hiring, compliance, payroll, benefits, and more, so you can focus on your business.